Rabobank gets closer to their customers

Looking to improve internal communication in your organization?

Take a look at how our other customers did it!

Measurable results from Haiilo in action

27.7m

People Reached

Enabling the bank to create discussions and get closer to their customers on the platforms they use day in, day out.

300k

Unique Visitors

Helping spread awareness about the bank and their mission to help the world become a more financially healthy and sustainable place.

97.6%

User Engagement

Employees are not only sharing Rabobank related material with their networks, they are also becoming more in touch with the Rabobank brand and mission.

What was their challenge

In the face of a digitizing world, Rabobank asked themselves a big question: how do we remain close to our customers when they prefer to do everything online?

Consumer behavior in the banking industry was increasingly going mobile and all based online. The new normal was that whenever a Rabobank customer wanted to interact with the bank, they were turning to their mobile devices and online portals.

Rabobank set out to adapt to the changes that were unfolding. They established a brand ambassador and customer engagement program to ensure that despite the shift Rabobank would remain close, or even become closer to their customers. Rabobank knew that the nature of their customer dialogue had to change: to remain near their customers, Rabobank had to engage with their customers on the medium they were already comfortable with – social media.

At Rabobank, we want to build lasting relationships with our customers. The trick is reaching our customers wherever they are comfortable being reached.

Tessa Wagensveld

Social Media Lead

Additionally, Rabobank was looking to reinforce their image as a “knowledge bank” by leveraging their extensive and broad-ranging experience. In essence, their challenge was becoming the go-to source of information in areas such as financial health, environmental considerations and global sustainability.

It’s not that the knowledge wasn’t there to begin with, the bottleneck was simply being able to reach enough people in their networks with the knowledge Rabobank already possessed.

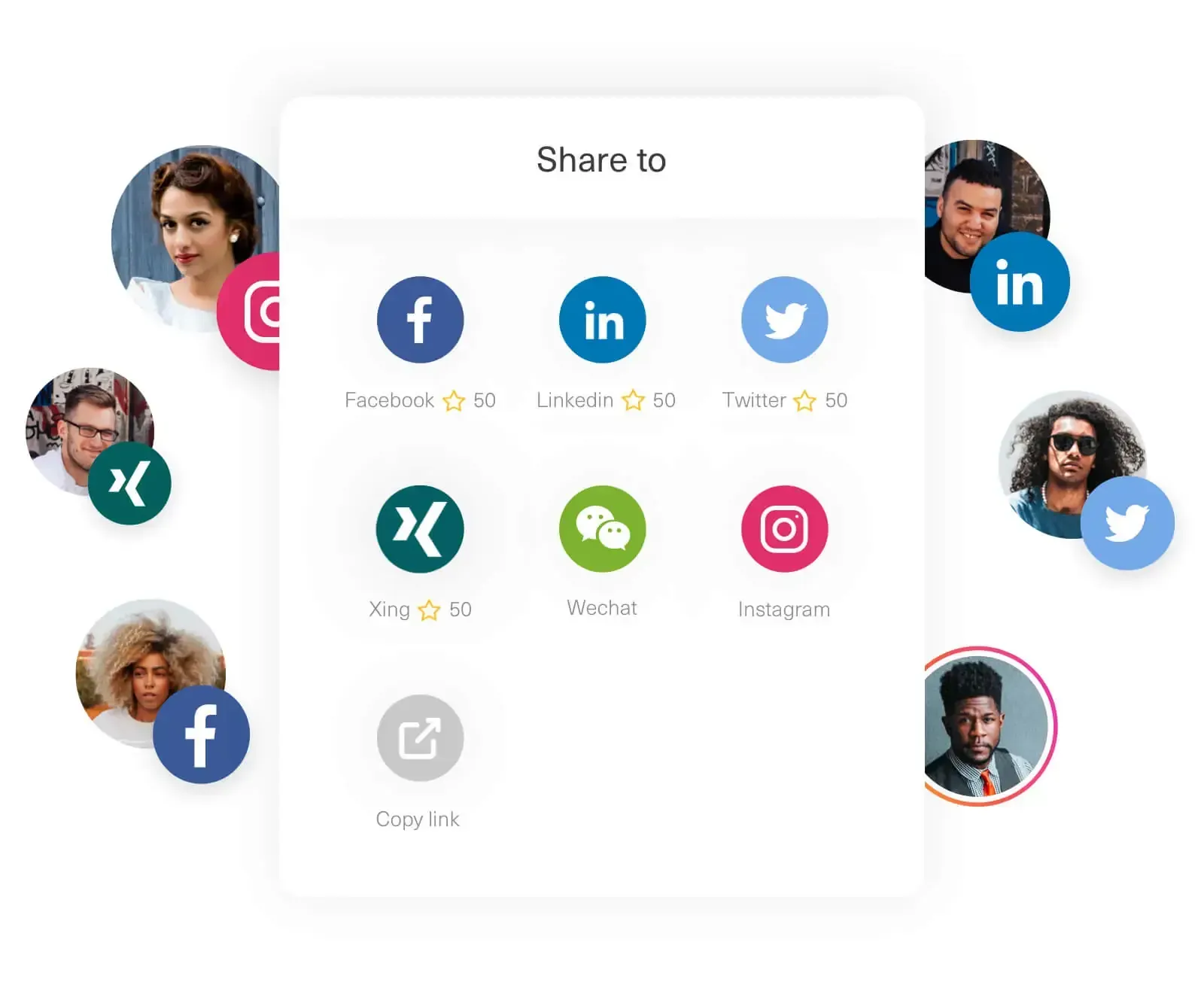

With this in mind, Rabobank needed a solution to not only enable their employees to initiate and engage in discussions with their networks on social media, they also needed a platform that could deliver relevant content and information to every employee and make it easy for them to spread the word.

Why was this important to their business

For Rabobank, there were clear benefits in being able to get closer to their customers as well as becoming the go-to source of information in the areas they knew best. If Rabobank were able to achieve these goals, they knew they would see improved customer satisfaction and increased brand awareness, which ultimately would help them grow their business.

This all started with trust. To establish trust, Rabobank account managers had to have a dialogue with their clients. Due to the shifting nature of banking and the reduced amount of face-to-face contact, Rabobank had to achieve this through online channels and social media.

Trust in the banking industry is the most important resource there is. If your bank doesn’t have trust, why would people let you manage their money? Why would they rely on you for a mortgage? As a bank, trust is the most valuable asset you can obtain. It is important for Rabobank to maintain that trusted position even in the face of a changing banking industry.

The impact of gaining and maintaining a high level of trust was a key priority for Rabobank as it has major implications across the entire business. By enabling employees to get closer to their customers, Rabobank not only expected increases in brand awareness and customer satisfaction, but enhanced customer engagement as well.

But Rabobank had goals that extended far beyond their own business needs. Being able to profile themselves as a knowledge bank meant that Rabobank would become a go-to source of information on financial health and sustainability for their networks. This in turn would greatly improve circumstances in their own living environment.

Which would lead to benefits for their country of origin – the Netherlands. Overall, this would eventually benefit the world and help it become a more responsible, sustainable place.

With our knowledge, we can help our network, and with our network we can help our living environment. That in turn helps the Netherlands as a whole, and ultimately helps the entire world.

Tessa Wagensveld

Social Media Lead

With goals ranging from improving brand awareness and customer satisfaction of the bank all the way to building a better living environment for future generations, Rabobank needed a platform that could scale to meet their needs.

How Haiilo helped with this

Haiilo supplied Rabobank with a comprehensive platform to help make their brand ambassador and customer engagement program a reality. Now Rabobank is able to provide employees with a relevant and real-time feed of approved communications and content which makes starting a discussion with their customers and networks as easy as clicking a single button.

Originally there had been a large gap between employees that wanted to spread the word about Rabobank and engage in online dialogue as well as those that actually followed through. Haiilo helps enable employees that are interested in contributing to the program, but don’t necessarily know where to start.

When Haiilo was rolled out, employees began reaching out requesting access to join the platform. Use of Haiilo grew organically, and it became apparent that Rabobank did not need to ask employees to be active – simply enabling them via Haiilo was enough to explode the reach and impact that Rabobank was having on their networks. The program also grew beyond employees that were already interested in acting as brand ambassadors, it began generating interest with all employees around the business.

With this program in place, Rabobank noticed that they were reaching their networks with a voice that sounded with much more authenticity than their corporate accounts could: the voice of their employees.

The response from our people internally was tremendous. I didn’t have to force anyone to join, they came to me asking for access. It became a situation where employees felt that they NEEDED access because of all the great content that they could find there.

Tessa Wagensveld

Social Media Lead

What KPI’s and business drivers did Haiilo help achieve

The impact that Haiilo has on key business drivers at Rabobank has been immense.

By enabling employees to create and engage in dialogue with their networks and by leveraging social selling, Rabobank has reached over 27.7 million people through social media over the previous calendar year. This has translated into nearly 300 000 additional, unique visitors to Rabobank-related materials – a metric which ultimately has led to improvements in brand awareness and overall growth in the business. All of this while generating an additional $865 000 worth of visibility on social media.

Overall, this has helped Rabobank reach their ultimate goal of getting closer to their customers. The bank has seen increased discussion online between employees and customers. This has continued to increase even throughout situations like the coronavirus pandemic, which has brought engaging customers online to the forefront of organizations around the world

Rabobank has seen great benefits not only externally, but internally as well. Since the beginning of 2020, Rabobank has maintained an average quarterly employee engagement rate of 97.6% on Haiilo. In other words, not only are employees maintaining close relationships with their customers and networks via social media, they are also staying up-to-date with what is happening with the company and industry directly on the Haiilo platform.

Additionally, Rabobank was able to reach one of their key business goals of driving positive societal impact through education on financial health and sustainability. Today, Rabobank is one of the foremost thought leaders in these areas, and their networks routinely turn to them for expertise. Rabobank tracks their progress against the Reptrak model – a framework that they reference to help guide their efforts around global citizenship. Rabobank has seen that having a positive impact as a global citizen has had a great impact on the growth of their business as well as overall satisfaction ratings